1. The basics of Bankomat Registration Process

We invite you to read our complete guide to the Bankomat registration procedure! The process of registering for a Bankomat card or an automated machine to transfer money (ATM) card is a crucial step to gain access to banking services. If you’re the first time or are looking to upgrade your current Bankomat card this article will give you useful tips and information to make sure you have a seamless and easy process of registration. From identifying the necessary documents and details to understanding the process of applying for a card we’ve got your back. Let’s get started and learn the most effective methods to ensure that your Bankomat registration an effortless process.

1. An Introduction Bankomat Registration Process

1.1 What exactly is a Bankomat?

If you’ve ever felt in need of cash traveling, you’ve likely come across the Bankomat. A Bankomat can also be referred to a ATM (Automated Teller Machine) is a practical self-service device which allows you to take cash out or check the balance on your account or even deposit funds. It’s a kind of personal bank teller, which is accessible all hours of the day, making it a crucial instrument for managing your finances.

1.2 Importantity of registering for Bankomat

Once you’ve figured out what a bankomat is we’ll discuss the reasons why it’s crucial to register for one. Registration for the Bankomat will allow you to customize your experience and get the most of its capabilities. After registering, you’ll be able connect your bank account and set up a PIN for extra security, and also be notified of your transactions. In addition, some Bankomat service providers provide additional advantages and rewards to users who are registered. If you’re interested in to have a seamless and easy experience each time you use the services of a Bankomat then registration is the best option.

2. Understanding the required documents and the Information

2.1 Important Documentation Required to Register a Bankomat

Before embarking on your Bankomat registration It is essential to collect all the required documents. In most cases, you’ll have to present proof of identity that is valid, like a identification card issued by the government or a passport. In addition, certain Bankomat service providers might require evidence of address. This could be any official document that demonstrates your current address, such as the utility bill or bank statement. Be sure to keep these documents on hand to speed up this registration procedure.

2.2 Personal Information as well as Identity Requirements

In addition to the necessary documentation, you’ll have to submit certain personal information when you complete the Bankomat registration procedure. This could include your full name, birth date as well as contact details, and in some instances the Social Security number. You can be sure that all of this information is required to safeguard your financial transactions and to guard against fraudulent transactions. Be sure to keep current and accurate information available to avoid delay.

3. Making the Right Preparations for a Successful Bankomat Registration

3.1 Collecting the Documents Required

Once you’ve identified the documents and other information you’ll require It’s time to organize everything together. You should create a checklist so that you don’t forget anything as, let’s face it the search for documents can be an arduous to find. Keep your ID and proof of address as well as any other documents you need to have in order and easily accessible. So, you can be able to breeze through registration without having to worry about last-minute issues.

3.2 Organizing Your Financial Information

Apart from the necessary documents It is also beneficial to keep your financial records well-organized. This includes having the details of your bank account like the account number, as well as any debit or credit cards. Knowing this information in advance will allow you to connect your bank account with the Bankomat in the process of registration. Additionally, it will ensure that you don’t have to spend time looking through your purse or wallet trying to find the card you’ve been looking for.

4. The Bankomat Application Process: Navigating

4.1 Selecting the Best Bankomat Provider

In the case of Bankomat registration Not all banks are all created to be the same. Spend some time researching and contrast the various Bankomat providers to discover the one that is most suitable for your requirements. Think about factors like the location, charges, and any other services or benefits they provide. Be aware that you’re not simply signing up to use the convenience of a Bankomat and a bank account, but rather to complete your bank experience. So make your choice carefully.

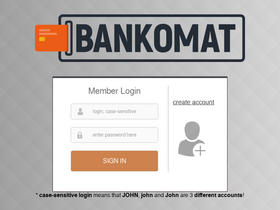

4.2 Step-by-Step Guide for Completing the Bankomat Application

After you’ve selected the best bankomat.cc provider is the time to jump into the application procedure. Each bank may have a few different procedures, however the process generally tends to be easy. It’s usually a matter of entering your personal information and identity information. You’ll then connect your bank account to establish a PIN for extra security. Then, you’ll be asked to sign these terms of service prior to you can complete the registration. Simply follow the prompts onscreen and, within minutes you’ll have become an authorized Bankomat user and ready to streamline bank transactions.

There you have the following suggestions to guide you over the Bankomat registration procedure. With the right documentation and a bit of organization and some study you’ll be well on the way to enjoying a the smoothest and most hassle-free banking available to you. Go on and take on these Bankomats like the financial super-hero you are!

5. Tips to ensure a smooth verification and Approval

5.1 Insuring the Accuracy and Completion of the Application

When filling in your Bankomat registration form It is crucial to pay attention to the details. Be sure that the information you supply is correct and complete. Check your address, name as well as contact information along with identification codes. A small error could create unnecessary delays during processing the process of verification. Therefore, it is important to go through your application before you submit it.

5.2 Monitoring Application Status

After you have submitted your Bankomat registration form Do not just relax and hope for the best. Keep track of the progress of your application on a regular basis. You can contact the bank’s customer support or visit the website for the latest information. Being proactive can not only provide you with peace of mind but let you address any concerns or supply additional documents promptly should you require it.

6. Troubleshooting Common Issues during Bankomat Registration

6.1 Handling Rejected Applications

It happens to everyone, even the most seasoned of us. If your Bankomat registration application gets rejected, don’t panic. Instead relax and figure out the reason for the rejection. It could be because of a minor error or an insufficient document. When you have identified the issue fix it and submit your application. It is important to remain steady and focused in solving any issues that occur.

6.2 Handling technical glitches or errors

Technology is often our greatest adversaries, but don’t allow it consume you when you’re going through the Bankomat registration procedure. If you experience any errors or technical issues in filling out your application online do not lose your cool. Note the error message down and then contact customer support. They’ll help and help you overcome any technical difficulties that occur.

7. The Best Practices to Secure Your Bankomat Account

7.1 Making an Unique and Strong PIN

When it comes to protecting the security of your Bankomat accounts, having a secure PIN is your primary option. Avoid using obvious or identifiable numbers, such as your birthdate or numbers with consecutive sequences. Instead, select an unusual combination that only you remember. Please, don’t note it down on a sticky notepad and put it on your card. It’s like laying across a carpet to avoid possible problems. Remember your PIN and make sure it’s kept private.

7.2 Security of your Bankomat Card and Personal Information

The Bankomat card is the ticket to your money be sure to be sure to guard it with all you power. Be careful when you use it at ATMs and point-of-sale terminals. Make sure nobody is watching at your back. Secure your card in a secure spot and notify your bank immediately if you suspect it has been missing or taken. Beware of scams involving phishing or fraud calls that ask for your card’s details or a PIN. Keep in mind that your bank will not request this details over the phone or via through email.

8. Final Recommendations to make your life easier Bankomat Registration

The process of registering for an account with a bankomat cc account shouldn’t cause stress. Be positive and be aware that any obstacle you come across are a matter of perseverance and patience. Make sure you read the instructions thoroughly Follow the guidelines and then contact Customer Support whenever you need. In time you’ll enjoy the convenience and ease that comes with using the Bankomat card as a professional!

8. Final Recommendations to make your life easier Bankomat Registration

In the end, a smooth and effortless Bankomat registration process could make a huge difference in having a smooth and easy access to banking services. If you are aware of the required documentation by preparing it in advance and following the guidelines and best practices outlined in this article to help you make registration without difficulty. Make sure you are vigilant in guarding your Bankomat account as well as your personal information and don’t be afraid to seek help or resolve any issues that occur. With these knowledge it is possible to tackle your Bankomat registration with confidence and benefit from the ease of the banking process.

FAQs

1. What exactly is Bankomat registration procedure?

It is the Bankomat registration process is the application to get an automatic ATM (ATM) card. This lets you connect to your account at a bank as well as perform different transactions at ATMs. The process typically involves providing the required documents, personal information as well as the verification and approval procedure.

2. What are the most common documents needed to be submitted for Bankomat registration?

The exact documents needed differ depending on the financial institution. The most common documents are evidence of identity (such as an ID card that is valid or a passport) and identification of residence (such as the utility bill or bank statement) and, sometimes, additional documents proving income or employment.

3. How long will the Bankomat registration procedure take?

The time required for your Bankomat registration process varies. In general, it takes anything from a few days to several weeks. The factors that affect the processing process include the effectiveness of the financial institution in terms of accuracy and completeness in the request, as well as other verification procedures needed.

4. What can I do what should I do if my Bankomat application is rejected?

When your Bankomat application is rejected it is crucial to contact your financial institution or bank to determine the reason for the rejection. They can offer advice on how to fix any problems or provide additional information needed to be approved. It’s also recommended to examine your application carefully and make sure that all information provided is up-to the date prior to applying again.